new short term capital gains tax proposal

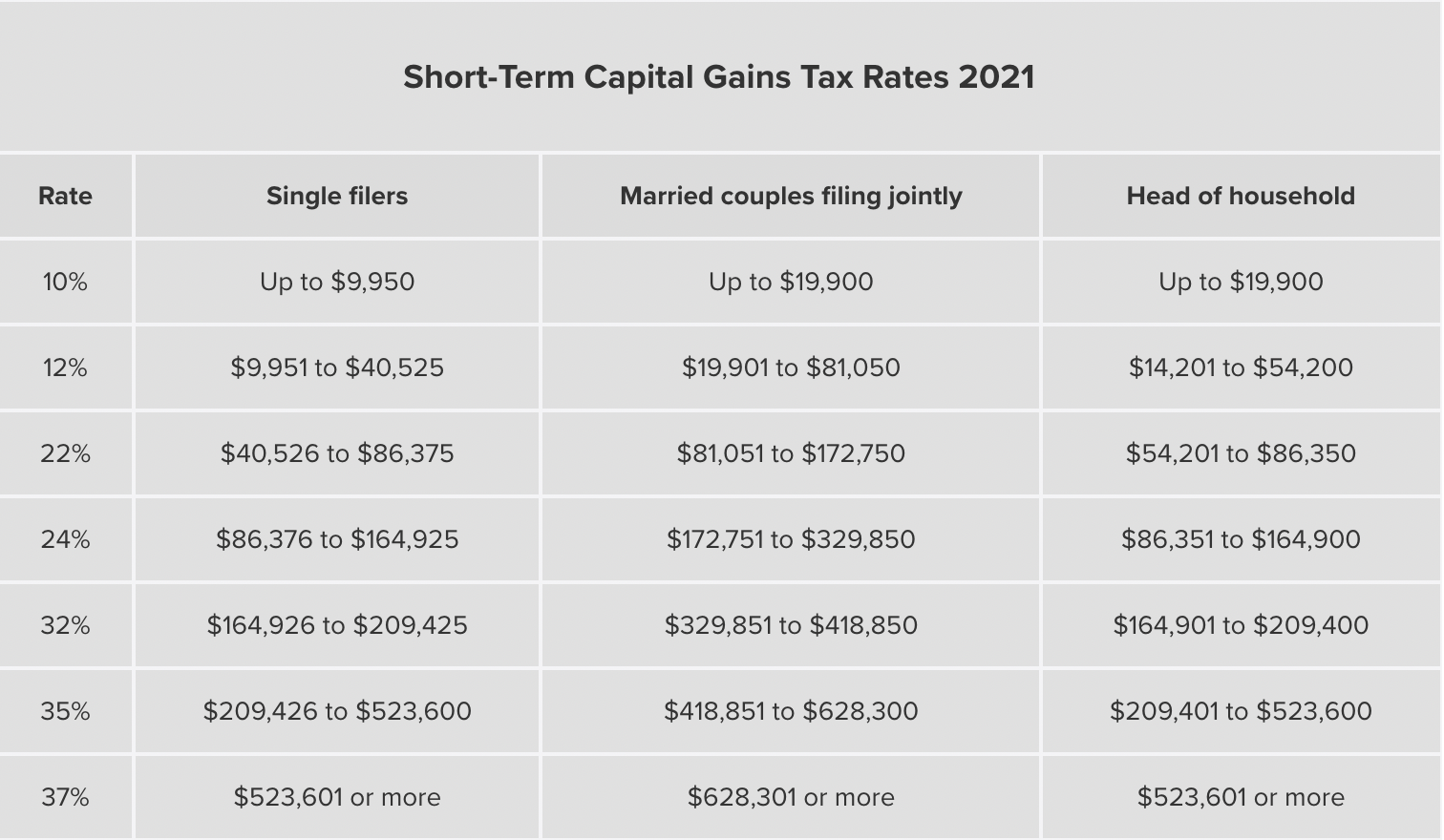

The top short-term capital gains tax rate is 37. History Of The Top Long-Term Capital Gains Tax Rate.

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

8 rows Short-term capital gains tax is a tax on gains resulting from the sale of assets.

. There is a risk in taking action before it becomes clear what changes Congress will make to the Administrations proposals. This isnt set for 2021 but the new budget includes it. Best short-term investments.

The latest proposal by the Biden administration includes up to a 434 short-term capital gains tax rate. 3 min read. Under the proposal 37 would generally be the highest individual tax rate or 408 including the net investment income tax but only if the taxpayers income exceeded 1 million or 500000 for taxpayers who are married filing separately indexed for inflation after 2022.

Now I dont mean to scare you. Govt plans reform in capital gains tax. 15 Mar 2022 0558 AM IST Gireesh Chandra.

The IRS taxes short-term capital gains like ordinary income. This was the month it was first announced. Currently all long-term capital gains are taxed at 20.

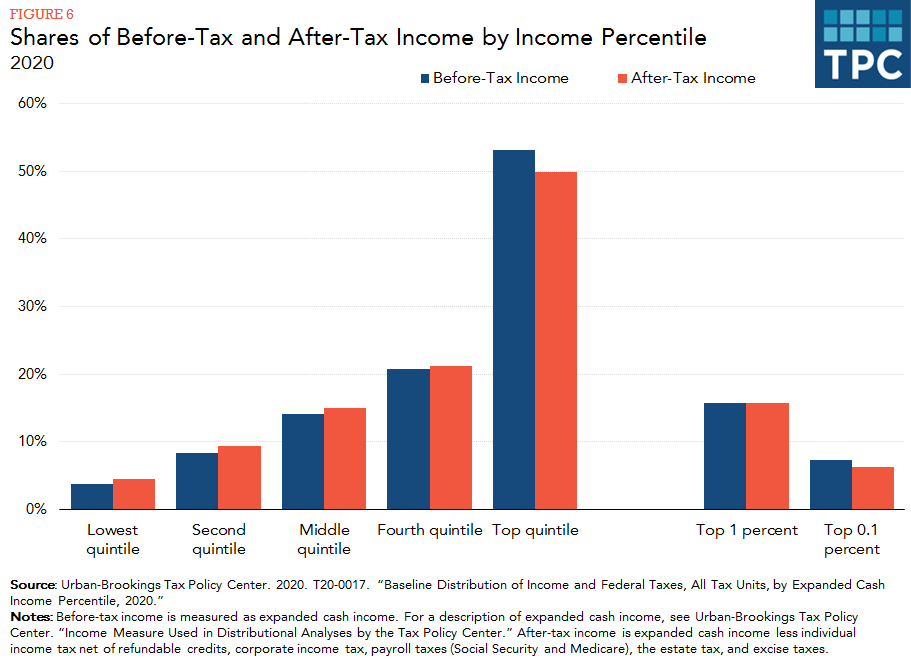

Under this proposed tax combined federal and state taxes on capital gains would average 48 percent itself a 66 percent increase over current law exceed 50 percent in thirteen states and the District of Columbia and reach 582 percent in New York City12 The combined average federal and state capital gains would surpass Denmark Chile and France to become. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. And part of the plan is making the new short-term capital gains tax retroactive to April 2021.

The proposed higher tax on capital gains would be consistent with President Bidens promise to limit tax increases to. Importantly Sanders plan would also add a new tax bracket of 52 percent on income over 10 million and apply a 4 percent income-based premium on all. This means that high-income single investors making over 523600 in tax year 2021 have to pay the top income tax bracket rate of 37.

The new tax would affect an estimated 58000 taxpayers in the first year. Under the current rules a 100000 long-term capital gain would face a 23800 tax bill at the federal level. Those earning income above 1 million would have their capital gainswhether short-term gains or long-term gainstaxed at 396 as well.

President Joe Biden is expected to propose raising the top federal capital gains tax to 396 from the current 20 for millionaires. With the proposed rates. Under the forthcoming proposal dubbed the American Families Plan the capital gains tax rate could increase to 396 from 20 for Americans earning more than 1 million a source familiar with.

Proposed capital gains tax Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion. Investors pay ordinary income tax rates on capital gains from short-term investment held for a year or less.

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. The new tax would affect an estimated 42000 taxpayers about 15 percent of households in the first year. For long-term investments held more than a year one of three capital gains rates.

More from Your Money Your Future. Short-term capital gains on listed equities held for under a year is taxed at 15. Adam Hinds D-Pittsfield questioned the timing of the capital gains tax cut he says would deliver 117 million largely for Massachusetts wealthiest families at a time.

Sole proprietor income retirement accounts homes farms and forestry are exempt. Sanders proposes taxing capital gains at the same rate as ordinary income for taxpayers with household income of 250000 and above which is where the current Net Investment Income Tax phases in. Currently the flat supplemental wage withholding rate which applies to income such as stock compensation and cash bonuses is 22 for yearly amounts up to 1 million and 37 for.

53 rows Under Bidens proposal for capital gains the US. Its important to note that Biden is also proposing a tax hikethat will raise the top income tax bracket from 37 to 396. Retirement accounts homes farms and forestry are exempt.

7 rows Federal short-term capital gainsincome tax rate Single Married filing jointly Married. Economy would be smaller American incomes. The top long-term capital gains rate has been 20 since 2013 according to.

The Green Book said the proposal would be effective for gains. Californias combined state and federal capital gains tax would be the highest at 567 followed by New York at 543 and New Jersey at 542 the study shows.

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Capital Gains Tax In Spain 2022 How Much Do I Have To Pay My Spain Visa

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

There S A Growing Interest In Wealth Taxes On The Super Rich

How Does The Personal Representative Executor Deal With The Income Tax And Capital Gains Tax Affairs Of The Deceased Low Incomes Tax Reform Group

Short Term Vs Long Term Capital Gains White Coat Investor

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

Rethinking How We Score Capital Gains Tax Reform Bfi

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World